Renters Insurance in and around Gaylord

Your renters insurance search is over, Gaylord

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or house, renters insurance can be the right next step to protect your stuff, including your linens, pots and pans, TV, video games, and more.

Your renters insurance search is over, Gaylord

Renting a home? Insure what you own.

Why Renters In Gaylord Choose State Farm

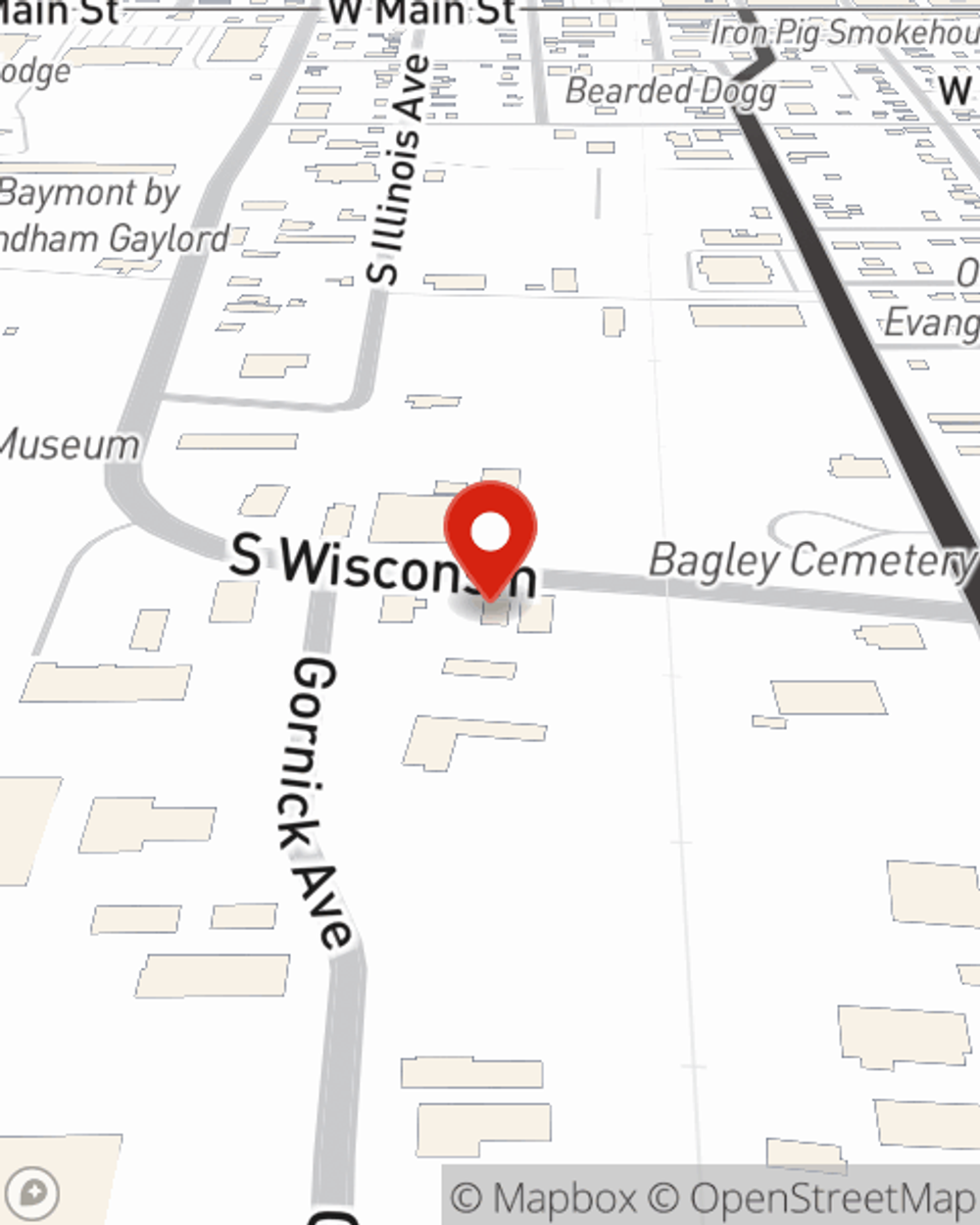

When renting makes the most sense for you, State Farm can help guard what you do own. State Farm agent Andy Patrick can help you identify the right coverage for when the unpredictable, like an accident or a fire, affects your personal belongings.

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Gaylord. Contact agent Andy Patrick's office to see about a renters insurance policy that fits your needs.

Have More Questions About Renters Insurance?

Call Andy at (989) 732-9081 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Andy Patrick

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.